Hotel Meeting Room

Hotel Meeting Room

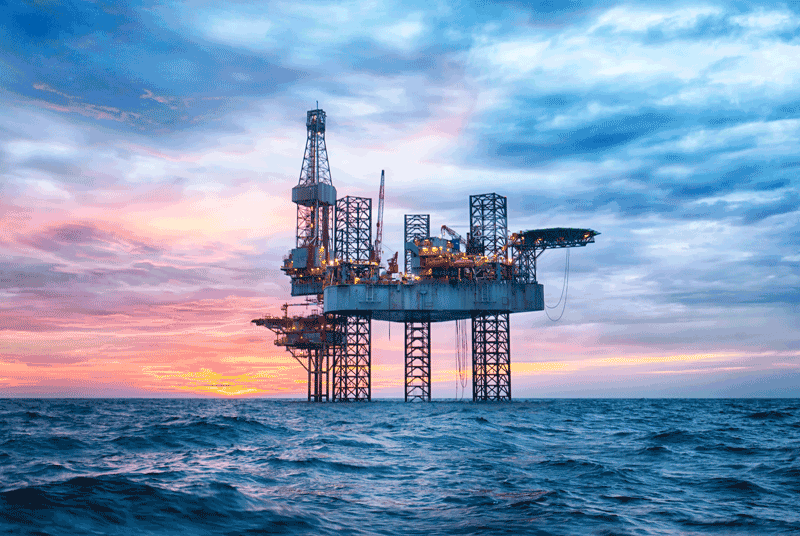

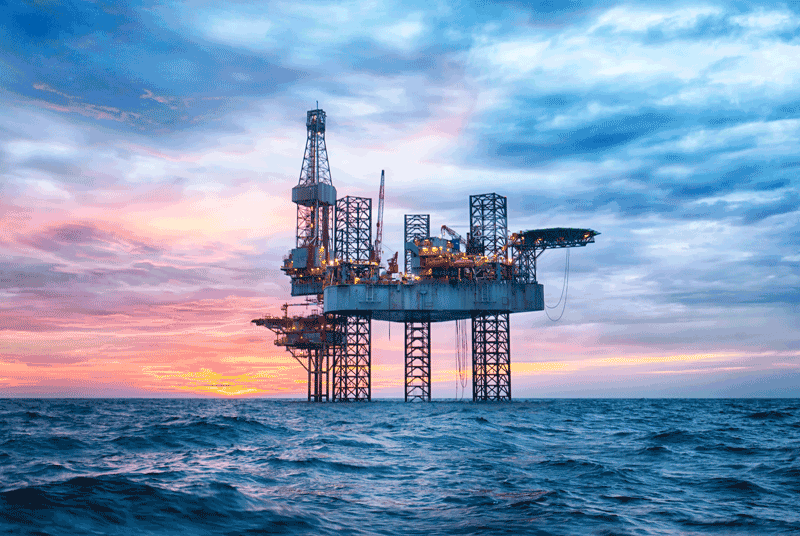

Petroleum, Oil , Gas Training Courses

Petroleum, Oil , Gas Training Courses

Hotel Meeting Room

Hotel Meeting Room Rome

Rome

Classroom

Overview ?

Economic evaluation in the oil and gas industry is an encompassing activity. It involves the bringing together of the principal technical and commercial dimensions of a project into a forecast of future performance, that allows different projects to be compared and ranked according to economic and/or other criteria. At its heart, economics is an organizing and quantification exercise. Increasingly, its boundaries are expanding to include a quantification of risk. Risk analysis is a rapidly growing discipline that can take many different forms. It is best understood and applied one step at a time – for professionals and for organizations.

This seminar takes a building block approach to understanding what economic and risk analysis is about. It is designed to become as sophisticated as its participants are comfortable. It will initially be a refresher course for those who are economics professionals and provide a framework for those who are not. We will advance our understanding as a group – learning from real examples and from each other – and we will take a hands-on approach at every opportunity. This is a course for anyone who has an interest in this field.

Introductions

Economics 101

The Economic Model

The Economic Model (cont’d)

Introduction To Risk

Statistics 101

An Exploration Example

A Development Example

Cost Analysis

Other Concepts

Recap

Day 1

Asset Cost Management Introduction

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 2

Laying the Groundwork

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 3

Applying the Value based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 4

Ensuring the Continuity of the Value-based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 5

Supporting Process that Lower Life-cycle costs

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Training Methodology

Pathways Training and consulting adopts the newest techniques of human resources Training and consulting and, with the following:

Course name

Duration

City

Price

Oil & Gas Economics & Risk Evaluation

16, Feb 2025 20, Feb 2025

Muscat

3250$

Oil & Gas Economics & Risk Evaluation

24, Feb 2025 28, Feb 2025

Toronto

6000$

Oil & Gas Economics & Risk Evaluation

03, Mar 2025 07, Mar 2025

Barcelona

5250$

Oil & Gas Economics & Risk Evaluation

10, Mar 2025 14, Mar 2025

London

5250$

Oil & Gas Economics & Risk Evaluation

16, Mar 2025 20, Mar 2025

DUBAI

3450$

Oil & Gas Economics & Risk Evaluation

24, Mar 2025 28, Mar 2025

Geneva

5250$

Oil & Gas Economics & Risk Evaluation

31, Mar 2025 04, Apr 2025

Vienna

5250$

Oil & Gas Economics & Risk Evaluation

07, Apr 2025 11, Apr 2025

Munich

5250$

Oil & Gas Economics & Risk Evaluation

14, Apr 2025 18, Apr 2025

Prague

5250$

Oil & Gas Economics & Risk Evaluation

21, Apr 2025 25, Apr 2025

Rome

5250$

Oil & Gas Economics & Risk Evaluation

28, Apr 2025 02, May 2025

Milan

5250$

Oil & Gas Economics & Risk Evaluation

28, Apr 2025 02, May 2025

Jakarta

4000$

Oil & Gas Economics & Risk Evaluation

04, May 2025 08, May 2025

Tunisia

3750$

Oil & Gas Economics & Risk Evaluation

12, May 2025 16, May 2025

Marbella

5250$

Oil & Gas Economics & Risk Evaluation

19, May 2025 23, May 2025

Paris

5250$

Oil & Gas Economics & Risk Evaluation

26, May 2025 30, May 2025

Madrid

5250$

Oil & Gas Economics & Risk Evaluation

01, Jun 2025 05, Jun 2025

DUBAI

3450$

Oil & Gas Economics & Risk Evaluation

09, Jun 2025 13, Jun 2025

Kuala Lumpur

3750$

Oil & Gas Economics & Risk Evaluation

15, Jun 2025 19, Jun 2025

Amman

3250$

Oil & Gas Economics & Risk Evaluation

22, Jun 2025 26, Jun 2025

Marrakesh

3450$

Oil & Gas Economics & Risk Evaluation

29, Jun 2025 03, Jul 2025

Sharm ElShaikh

3250$

Oil & Gas Economics & Risk Evaluation

06, Jul 2025 10, Jul 2025

Doha

4000$

Oil & Gas Economics & Risk Evaluation

13, Jul 2025 17, Jul 2025

Casablanca

3450$

Oil & Gas Economics & Risk Evaluation

20, Jul 2025 24, Jul 2025

Riyadh

3250$

Oil & Gas Economics & Risk Evaluation

28, Jul 2025 01, Aug 2025

Istanbul

3450$

Oil & Gas Economics & Risk Evaluation

28, Jul 2025 01, Aug 2025

Milan

5250$

Oil & Gas Economics & Risk Evaluation

03, Aug 2025 07, Aug 2025

Jeddah

3250$

Oil & Gas Economics & Risk Evaluation

10, Aug 2025 14, Aug 2025

Manama

3250$

Oil & Gas Economics & Risk Evaluation

17, Aug 2025 21, Aug 2025

Beirut

3250$

Oil & Gas Economics & Risk Evaluation

25, Aug 2025 29, Aug 2025

Singapore

5450$

Oil & Gas Economics & Risk Evaluation

31, Aug 2025 04, Sep 2025

Kuwait

3250$

Oil & Gas Economics & Risk Evaluation

07, Sep 2025 11, Sep 2025

DUBAI

3450$

Oil & Gas Economics & Risk Evaluation

15, Sep 2025 19, Sep 2025

Kuala Lumpur

3750$

Oil & Gas Economics & Risk Evaluation

21, Sep 2025 25, Sep 2025

Amman

3250$

Oil & Gas Economics & Risk Evaluation

28, Sep 2025 02, Oct 2025

Marrakesh

3450$

Oil & Gas Economics & Risk Evaluation

05, Oct 2025 09, Oct 2025

Sharm ElShaikh

3250$

Oil & Gas Economics & Risk Evaluation

12, Oct 2025 16, Oct 2025

Doha

4000$

Oil & Gas Economics & Risk Evaluation

19, Oct 2025 23, Oct 2025

Casablanca

3450$

Oil & Gas Economics & Risk Evaluation

26, Oct 2025 30, Oct 2025

Riyadh

3250$

Oil & Gas Economics & Risk Evaluation

03, Nov 2025 07, Nov 2025

Istanbul

3450$

Oil & Gas Economics & Risk Evaluation

09, Nov 2025 13, Nov 2025

Jeddah

3250$

Oil & Gas Economics & Risk Evaluation

16, Nov 2025 20, Nov 2025

Manama

3250$

Oil & Gas Economics & Risk Evaluation

23, Nov 2025 27, Nov 2025

Beirut

3250$

Oil & Gas Economics & Risk Evaluation

01, Dec 2025 05, Dec 2025

Singapore

5450$

Oil & Gas Economics & Risk Evaluation

07, Dec 2025 11, Dec 2025

Kuwait

3250$

Oil & Gas Economics & Risk Evaluation

15, Dec 2025 19, Dec 2025

Berlin

5250$

Oil & Gas Economics & Risk Evaluation

22, Dec 2025 26, Dec 2025

Brussels

5250$

Oil & Gas Economics & Risk Evaluation

29, Dec 2025 02, Jan 2026

Berlin

5250$

View course

View course

View course

View course

View course

View course