Hotel Meeting Room

Hotel Meeting Room

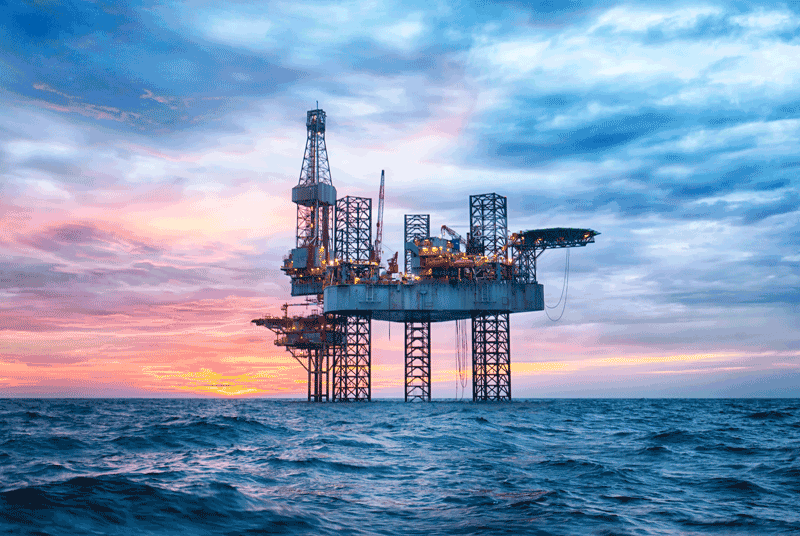

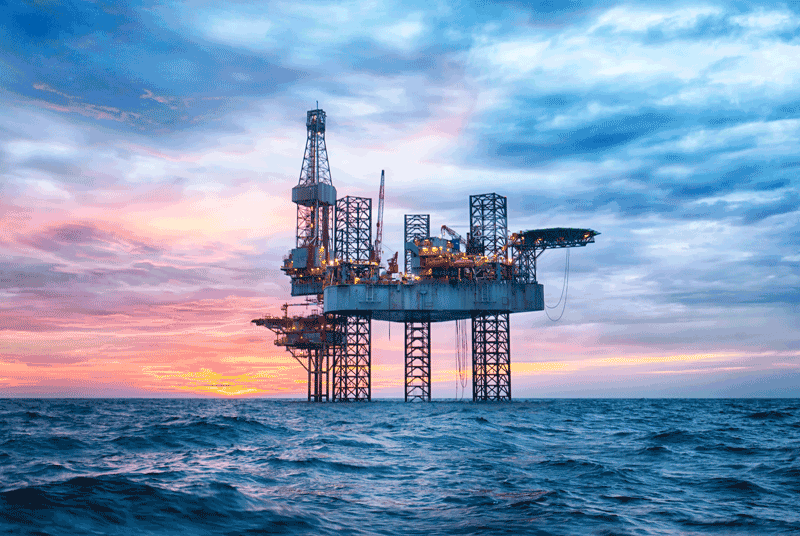

Petroleum, Oil , Gas Training Courses

Petroleum, Oil , Gas Training Courses

Hotel Meeting Room

Hotel Meeting Room Rome

Rome

Classroom

Overview ?

Large capital-intensive projects in the oil and gas industries require substantial - and mostly risky - investments in the acquisition, exploration, and subsequent operation and maintenance of new organizational assets.

The decision whether or not to invest in new capital projects in the oil and gas industry, starts with critical decisions during the exploration phase of a new development, or the expansion of an existing field. The decision-making tools used to analyze project risk under conditions of uncertainty will help companies to determine the probability of success or loss, and will drive the decision to develop or abandon the well.

Of paramount importance therefore, is the systematic and comprehensive evaluation of potential investments, and the development of detailed cash-flow analyses to determine as accurately as possible, the expected returns to the organization under varying conditions of uncertainty over the expected productive life of the project.

This requires the development of sound, realistic, and carefully structured cash-flow projections, reflecting both the initial capital expenditures required for the acquisition of the asset, as well as the operational expenditures required for successful operation and maintenance of the asset over its anticipated productive life.

World-wide an alarming number of large capital projects fail to meet, or overrun their planned budgets, failing to realize both the financial and strategic goals of the organization - the very reason for their being undertaken in the first place - often with sizable increases in capital and operational expenditures, and with substantial financial losses to the organization. In the majority of cases, this is the inevitable consequence of failing to apply the tools and techniques of modern project decision-making, evaluation, financial planning, capital management and cash flow analysis when considering investment into new capital projects.

Delegates will develop advanced financial analysis and cash flow management skills through formal and interactive learning methods. The program includes individual exercises, team projects, applicable case studies, group discussions and video material that will bring to life the skills acquired throughout the course.

The material has been designed to enable delegates to apply all of the material with immediate effect back at the office.

Additionally, the seminar does not assume prior knowledge of the topics covered in the course. New concepts and tools are introduced gradually to enable delegates to progress from the fundamental to the advanced concepts of asset-based financial engineering.

Day 1

Asset Cost Management Introduction

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 2

Laying the Groundwork

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 3

Applying the Value based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 4

Ensuring the Continuity of the Value-based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 5

Supporting Process that Lower Life-cycle costs

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Training Methodology

Pathways Training and consulting adopts the newest techniques of human resources Training and consulting and, with the following:

Course name

Duration

City

Price

Managing Business Risk

07, Jul 2025 11, Jul 2025

Rome

5250$

Managing Business Risk

14, Jul 2025 18, Jul 2025

Jakarta

4000$

Managing Business Risk

20, Jul 2025 24, Jul 2025

Tunisia

3750$

Managing Business Risk

28, Jul 2025 01, Aug 2025

Marbella

5250$

Managing Business Risk

03, Aug 2025 07, Aug 2025

Khobar

3250$

Managing Business Risk

04, Aug 2025 08, Aug 2025

Paris

5250$

Managing Business Risk

11, Aug 2025 15, Aug 2025

Madrid

5250$

Managing Business Risk

17, Aug 2025 21, Aug 2025

DUBAI

3450$

Managing Business Risk

25, Aug 2025 29, Aug 2025

Kuala Lumpur

3750$

Managing Business Risk

31, Aug 2025 04, Sep 2025

Amman

3250$

Managing Business Risk

07, Sep 2025 11, Sep 2025

Marrakesh

3450$

Managing Business Risk

14, Sep 2025 18, Sep 2025

Sharm ElShaikh

3250$

Managing Business Risk

21, Sep 2025 25, Sep 2025

Doha

4000$

Managing Business Risk

28, Sep 2025 02, Oct 2025

Casablanca

3450$

Managing Business Risk

05, Oct 2025 09, Oct 2025

Riyadh

3250$

Managing Business Risk

13, Oct 2025 17, Oct 2025

Istanbul

3450$

Managing Business Risk

19, Oct 2025 23, Oct 2025

Jeddah

3250$

Managing Business Risk

26, Oct 2025 30, Oct 2025

Manama

3250$

Managing Business Risk

02, Nov 2025 06, Nov 2025

Beirut

3250$

Managing Business Risk

10, Nov 2025 14, Nov 2025

Milan

5250$

Managing Business Risk

10, Nov 2025 14, Nov 2025

Singapore

5450$

Managing Business Risk

16, Nov 2025 20, Nov 2025

Kuwait

3250$

Managing Business Risk

23, Nov 2025 27, Nov 2025

DUBAI

3450$

Managing Business Risk

01, Dec 2025 05, Dec 2025

Kuala Lumpur

3750$

Managing Business Risk

07, Dec 2025 11, Dec 2025

Amman

3250$

Managing Business Risk

14, Dec 2025 18, Dec 2025

Marrakesh

3450$

Managing Business Risk

21, Dec 2025 25, Dec 2025

Sharm ElShaikh

3250$

Managing Business Risk

28, Dec 2025 01, Jan 2026

Marrakesh

3450$

View course

View course

View course

View course

View course

View course