Hotel Meeting Room

Hotel Meeting Room

Finance, Accounting , Budgeting Training Courses

Finance, Accounting , Budgeting Training Courses

Hotel Meeting Room

Hotel Meeting Room Kuala Lumpur

Kuala Lumpur

Classroom

Overview ?

It is crucial that today’s business professionals understand the flow of financial resources. Such an understanding is needed daily; whether it is used to anticipate trends, evaluate company performance or obtain funding. People from non-financial backgrounds are often called upon to make decisions based on modern financial products, and they must have the know-how to navigate the financial systems that have a significant impact on their professional responsibilities.

Oxford Management Centre has created the 5 Day MBA in Finance to provide business professionals with a deeper understanding of corporate finance as practiced by today’s most powerful companies. Designed specifically for non-financial personnel, this intensive seminar approaches the subject of finance as it relates to the corporation as a whole.

Extensive and deep coverage of the subject area

Real world approach to the discipline

Numerous examples based around market data

Contemporary approach drawing on recent market developments

Integration with spreadsheet modelling

What is the appropriate discount rate to be used in investment appraisal?

What are the “pros” and cons’ of different types of financing?

What factors must be considered in deciding on a dividend policy?

What is the exact nature and scope of the issue to be analyzed?

What products are available to manage risk?

Why is correlation so important in managing risk?

Which specific variables, relationships, and trends are likely to be helpful in analyzing an annual report

Using a combination of lectures, group exercises and individual exercises with practical applications, the delegates will gain both a theoretical and practical knowledge of the topics covered. The emphasis is on the “real world” and as a result delegates will return to the workplace with both the ability and the confidence to apply the techniques learned.

Delegates are requested to please bring a notebook PC to the seminars.

Providing delegates with a concentrated and focused programme in finance addressing key topics found on MBA’s in finance throughout the world

Updating IT skills by demonstrating the use of financial software in assisting in the decision making process.

Updating delegates with recent developments in risk management

Providing exposure to numerous annual reports and real life cases

Emphasising the role of risk in decision making

Explaining how risk can be measured and quantified

The ability to actively participate in finance decision making

An appreciation of the relative merits of varying asset classes.

Recognition of the importance of risk in determining the cost of capital

An ability to utilise sophisticated investment appraisal techniques

An appreciation of the key items from an annual report and recognition of important ratios and linkages

Recognition of the appropriate tool to manage risk

Professionals integral to the decision making process

Non-Financial business professionals managing who have been promoted to financial positions

Financial professionals wanting an update or a “refresher” of their knowledge

Junior managers working in the finance area

Day 1 – An Introduction to the Financial Markets

|

Day 2 – Evaluating Investment Opportunities

|

Day 3 – A Walk through an Annual Report

|

Day 4 – The Corporate Financing Decision

|

Day 5 – Risk Management

|

Day 1

Asset Cost Management Introduction

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 2

Laying the Groundwork

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 3

Applying the Value based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 4

Ensuring the Continuity of the Value-based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 5

Supporting Process that Lower Life-cycle costs

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Training Methodology

Pathways Training and consulting adopts the newest techniques of human resources Training and consulting and, with the following:

Course name

Duration

City

Price

The 5_Day MBA in Finance

16, Feb 2025 20, Feb 2025

Jeddah

2750$

The 5_Day MBA in Finance

23, Feb 2025 27, Feb 2025

Manama

2750$

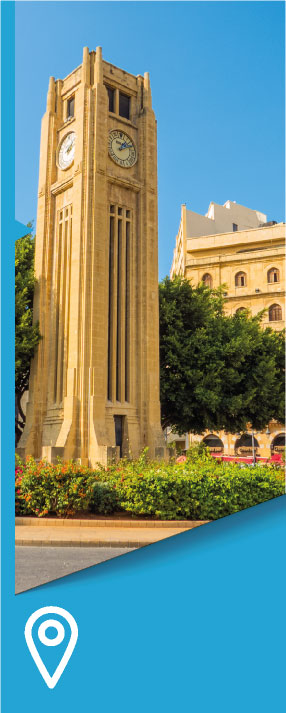

The 5_Day MBA in Finance

02, Mar 2025 06, Mar 2025

Beirut

2750$

The 5_Day MBA in Finance

10, Mar 2025 14, Mar 2025

Singapore

4950$

The 5_Day MBA in Finance

16, Mar 2025 20, Mar 2025

Kuwait

2750$

The 5_Day MBA in Finance

17, Mar 2025 21, Mar 2025

Milan

4750$

The 5_Day MBA in Finance

23, Mar 2025 27, Mar 2025

DUBAI

2950$

The 5_Day MBA in Finance

31, Mar 2025 04, Apr 2025

Kuala Lumpur

3250$

The 5_Day MBA in Finance

06, Apr 2025 10, Apr 2025

Amman

2750$

The 5_Day MBA in Finance

13, Apr 2025 17, Apr 2025

Marrakesh

2950$

The 5_Day MBA in Finance

14, Apr 2025 18, Apr 2025

Milan

4750$

The 5_Day MBA in Finance

20, Apr 2025 24, Apr 2025

Sharm ElShaikh

2750$

The 5_Day MBA in Finance

27, Apr 2025 01, May 2025

Doha

3500$

The 5_Day MBA in Finance

04, May 2025 08, May 2025

Casablanca

2950$

The 5_Day MBA in Finance

11, May 2025 15, May 2025

Riyadh

2750$

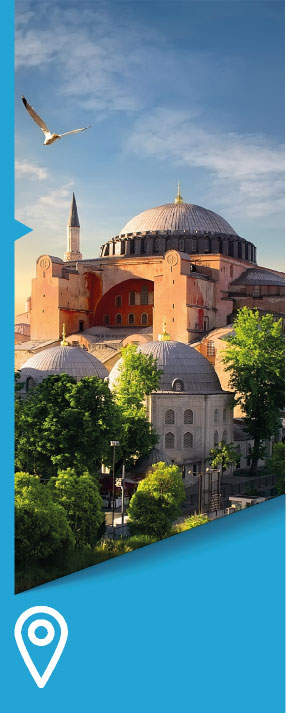

The 5_Day MBA in Finance

19, May 2025 23, May 2025

Istanbul

2950$

The 5_Day MBA in Finance

25, May 2025 29, May 2025

Jeddah

2750$

The 5_Day MBA in Finance

01, Jun 2025 05, Jun 2025

Manama

2750$

The 5_Day MBA in Finance

08, Jun 2025 12, Jun 2025

Beirut

2750$

The 5_Day MBA in Finance

16, Jun 2025 20, Jun 2025

Singapore

4950$

The 5_Day MBA in Finance

22, Jun 2025 26, Jun 2025

Kuwait

2750$

The 5_Day MBA in Finance

30, Jun 2025 04, Jul 2025

Berlin

4750$

The 5_Day MBA in Finance

07, Jul 2025 11, Jul 2025

Brussels

4750$

The 5_Day MBA in Finance

14, Jul 2025 18, Jul 2025

Zurich

4750$

The 5_Day MBA in Finance

21, Jul 2025 25, Jul 2025

Trabzon

3500$

The 5_Day MBA in Finance

27, Jul 2025 31, Jul 2025

Khobar

2750$

The 5_Day MBA in Finance

28, Jul 2025 01, Aug 2025

Beijing

4950$

The 5_Day MBA in Finance

04, Aug 2025 08, Aug 2025

Amsterdam

4750$

The 5_Day MBA in Finance

11, Aug 2025 15, Aug 2025

Bangkok

4950$

The 5_Day MBA in Finance

17, Aug 2025 21, Aug 2025

Muscat

2750$

The 5_Day MBA in Finance

25, Aug 2025 29, Aug 2025

Toronto

5500$

The 5_Day MBA in Finance

01, Sep 2025 05, Sep 2025

Barcelona

4750$

The 5_Day MBA in Finance

08, Sep 2025 12, Sep 2025

London

4750$

The 5_Day MBA in Finance

14, Sep 2025 18, Sep 2025

Cairo

2450$

The 5_Day MBA in Finance

22, Sep 2025 26, Sep 2025

Geneva

4750$

The 5_Day MBA in Finance

29, Sep 2025 03, Oct 2025

Vienna

4750$

The 5_Day MBA in Finance

06, Oct 2025 10, Oct 2025

Munich

4750$

The 5_Day MBA in Finance

13, Oct 2025 17, Oct 2025

Prague

4750$

The 5_Day MBA in Finance

20, Oct 2025 24, Oct 2025

Rome

4750$

The 5_Day MBA in Finance

26, Oct 2025 30, Oct 2025

DUBAI

2950$

The 5_Day MBA in Finance

27, Oct 2025 31, Oct 2025

Jakarta

3500$

The 5_Day MBA in Finance

02, Nov 2025 06, Nov 2025

Tunisia

3250$

The 5_Day MBA in Finance

10, Nov 2025 14, Nov 2025

Marbella

4750$

The 5_Day MBA in Finance

17, Nov 2025 21, Nov 2025

Paris

4750$

The 5_Day MBA in Finance

24, Nov 2025 28, Nov 2025

Madrid

4750$

The 5_Day MBA in Finance

30, Nov 2025 04, Dec 2025

DUBAI

2950$

The 5_Day MBA in Finance

08, Dec 2025 12, Dec 2025

Kuala Lumpur

3250$

The 5_Day MBA in Finance

14, Dec 2025 18, Dec 2025

Amman

2750$

The 5_Day MBA in Finance

21, Dec 2025 25, Dec 2025

Marrakesh

2950$

The 5_Day MBA in Finance

28, Dec 2025 01, Jan 2026

Amman

2750$

View course

View course

View course

View course

View course

View course