Hotel Meeting Room

Hotel Meeting Room

Finance, Accounting , Budgeting Training Courses

Finance, Accounting , Budgeting Training Courses

Hotel Meeting Room

Hotel Meeting Room Amman

Amman

Classroom

Overview ?

This course offers an in-depth overview of the accounting and finance world. Part 1 emphasized the internal workings of the finance/control function as it communicates with external and internal constituencies to provide information for decision making under uncertainty. Part 2 emphasizes the capital markets impact on corporate finance, risk, and governance.

No preparation is necessary except to bring an open mind and a budget document or other financial documents of interest.

By combining techniques with analysis, problems and examples with real case studies, and supporting theories the course provides delegates with key finance terminology and practice. This course not only presents the key financial tools generally used, but also explains the broader context of how and where they are applied to obtain meaningful answers. It provides a conceptual backdrop both for the financial/economic dimensions of strategic business management and for understanding the nature of financial statements, analyzing data, planning and controlling.

The course is targeted at providing a university-quality ‘MBA’ overview of finance/accounting, planning/control, risk management, and corporate governance. Participants are expected to be high-potential learners seeking the next level of learning. Additional bibliographies, readings, and spreadsheets will be provided as takeaways.

Module 1 - Accounting, Decision Making, & Financial Communication

Module 2 - Finance, Risk Management & Corporate Governance

This workshop will be highly participatory and your seminar leader will present, guide and facilitate learning, using a range of methods including discussions, case studies and exercises. Where appropriate, these will include real issues brought to the workshop by delegates.

Lessons learned from the seminar will be applied to your own organization. Key performance indicators (KPIs) for the critical success factors (CSFs) will focus attention on high priority action plans for taking back to your organization.

Day 1

Asset Cost Management Introduction

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 2

Laying the Groundwork

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 3

Applying the Value based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 4

Ensuring the Continuity of the Value-based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 5

Supporting Process that Lower Life-cycle costs

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Training Methodology

Pathways Training and consulting adopts the newest techniques of human resources Training and consulting and, with the following:

Course name

Duration

City

Price

Advanced Accounting & Finance Management

17, Feb 2025 28, Feb 2025

Marbella

6950$

Advanced Accounting & Finance Management

24, Feb 2025 07, Mar 2025

Paris

6950$

Advanced Accounting & Finance Management

03, Mar 2025 14, Mar 2025

Madrid

4950$

Advanced Accounting & Finance Management

09, Mar 2025 20, Mar 2025

DUBAI

4750$

Advanced Accounting & Finance Management

17, Mar 2025 28, Mar 2025

Kuala Lumpur

4500$

Advanced Accounting & Finance Management

23, Mar 2025 03, Apr 2025

Amman

4750$

Advanced Accounting & Finance Management

30, Mar 2025 10, Apr 2025

Marrakesh

4750$

Advanced Accounting & Finance Management

06, Apr 2025 17, Apr 2025

Sharm ElShaikh

4750$

Advanced Accounting & Finance Management

13, Apr 2025 24, Apr 2025

Doha

5500$

Advanced Accounting & Finance Management

14, Apr 2025 25, Apr 2025

Washington

7950$

Advanced Accounting & Finance Management

20, Apr 2025 01, May 2025

Khobar

4750$

Advanced Accounting & Finance Management

20, Apr 2025 01, May 2025

Casablanca

4950$

Advanced Accounting & Finance Management

27, Apr 2025 08, May 2025

Riyadh

4750$

Advanced Accounting & Finance Management

28, Apr 2025 09, May 2025

Milan

6950$

Advanced Accounting & Finance Management

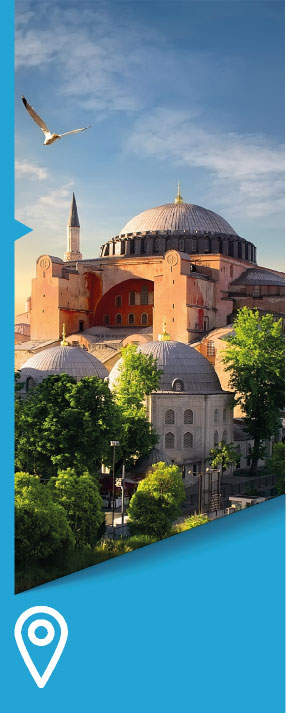

05, May 2025 16, May 2025

Istanbul

4750$

Advanced Accounting & Finance Management

11, May 2025 22, May 2025

Jeddah

4750$

Advanced Accounting & Finance Management

18, May 2025 29, May 2025

Manama

4750$

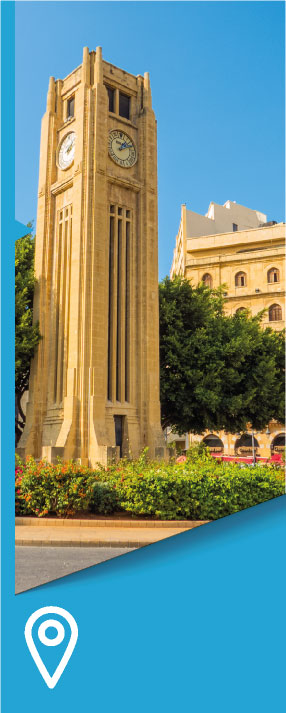

Advanced Accounting & Finance Management

25, May 2025 05, Jun 2025

Beirut

4750$

Advanced Accounting & Finance Management

02, Jun 2025 13, Jun 2025

Singapore

6950$

Advanced Accounting & Finance Management

08, Jun 2025 19, Jun 2025

Kuwait

4750$

Advanced Accounting & Finance Management

15, Jun 2025 26, Jun 2025

DUBAI

4750$

Advanced Accounting & Finance Management

23, Jun 2025 04, Jul 2025

Kuala Lumpur

4500$

Advanced Accounting & Finance Management

29, Jun 2025 10, Jul 2025

Amman

4750$

Advanced Accounting & Finance Management

06, Jul 2025 17, Jul 2025

Marrakesh

4750$

Advanced Accounting & Finance Management

13, Jul 2025 24, Jul 2025

Sharm ElShaikh

4750$

Advanced Accounting & Finance Management

20, Jul 2025 31, Jul 2025

Doha

5500$

Advanced Accounting & Finance Management

27, Jul 2025 07, Aug 2025

Casablanca

4950$

Advanced Accounting & Finance Management

03, Aug 2025 14, Aug 2025

Riyadh

4750$

Advanced Accounting & Finance Management

11, Aug 2025 22, Aug 2025

Istanbul

4750$

Advanced Accounting & Finance Management

17, Aug 2025 28, Aug 2025

Jeddah

4750$

Advanced Accounting & Finance Management

24, Aug 2025 04, Sep 2025

Manama

4750$

Advanced Accounting & Finance Management

31, Aug 2025 11, Sep 2025

Beirut

4750$

Advanced Accounting & Finance Management

08, Sep 2025 19, Sep 2025

Singapore

6950$

Advanced Accounting & Finance Management

14, Sep 2025 25, Sep 2025

Kuwait

4750$

Advanced Accounting & Finance Management

22, Sep 2025 03, Oct 2025

Berlin

6950$

Advanced Accounting & Finance Management

29, Sep 2025 10, Oct 2025

Brussels

6950$

Advanced Accounting & Finance Management

06, Oct 2025 17, Oct 2025

Zurich

6950$

Advanced Accounting & Finance Management

13, Oct 2025 24, Oct 2025

Milan

6950$

Advanced Accounting & Finance Management

20, Oct 2025 31, Oct 2025

Beijing

6950$

Advanced Accounting & Finance Management

27, Oct 2025 07, Nov 2025

Amsterdam

6950$

Advanced Accounting & Finance Management

03, Nov 2025 14, Nov 2025

Bangkok

6950$

Advanced Accounting & Finance Management

09, Nov 2025 20, Nov 2025

Muscat

4750$

Advanced Accounting & Finance Management

17, Nov 2025 28, Nov 2025

Toronto

7250$

Advanced Accounting & Finance Management

24, Nov 2025 05, Dec 2025

Barcelona

6950$

Advanced Accounting & Finance Management

01, Dec 2025 12, Dec 2025

London

6950$

Advanced Accounting & Finance Management

07, Dec 2025 18, Dec 2025

Cairo

3950$

Advanced Accounting & Finance Management

14, Dec 2025 25, Dec 2025

DUBAI

4750$

Advanced Accounting & Finance Management

22, Dec 2025 02, Jan 2026

Vienna

6950$

Advanced Accounting & Finance Management

29, Dec 2025 09, Jan 2026

Geneva

6950$

View course

View course

View course

View course

View course

View course