Hotel Meeting Room

Hotel Meeting Room

Finance, Accounting , Budgeting Training Courses

Finance, Accounting , Budgeting Training Courses

Hotel Meeting Room

Hotel Meeting Room Washington

Washington

Classroom

Overview ?

By the end of this training course, you will be able to:

This training course is of direct relevance to governance, risk management and compliance and as a result the organizations will benefit greatly from their employee’s participation. The organization will gain from:

This training course will be of personal benefit to delegates by providing you with:

This training course is designed to deliver the knowledge and skills, providing details of the latest policies and procedures to:

Day 1

Asset Cost Management Introduction

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 2

Laying the Groundwork

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 3

Applying the Value based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 4

Ensuring the Continuity of the Value-based Process

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Day 5

Supporting Process that Lower Life-cycle costs

Definitions of reliability, maintenance & asset management

The total cost of maintenance

Best practice reliability and maintenance processes

Elements of asset management best practice

Auditing performance

Overview of TPM, RCM, BCM, QCM, and other asset management buzzword

Open discussion sessions

Training Methodology

Pathways Training and consulting adopts the newest techniques of human resources Training and consulting and, with the following:

Course name

Duration

City

Price

Governance Risk Management and Compliance (GRC)

17, Feb 2025 28, Feb 2025

Paris

6950$

Governance Risk Management and Compliance (GRC)

24, Feb 2025 07, Mar 2025

Madrid

4950$

Governance Risk Management and Compliance (GRC)

02, Mar 2025 13, Mar 2025

DUBAI

4750$

Governance Risk Management and Compliance (GRC)

10, Mar 2025 21, Mar 2025

Kuala Lumpur

4500$

Governance Risk Management and Compliance (GRC)

16, Mar 2025 27, Mar 2025

Amman

4750$

Governance Risk Management and Compliance (GRC)

17, Mar 2025 28, Mar 2025

Milan

6950$

Governance Risk Management and Compliance (GRC)

23, Mar 2025 03, Apr 2025

Marrakesh

4750$

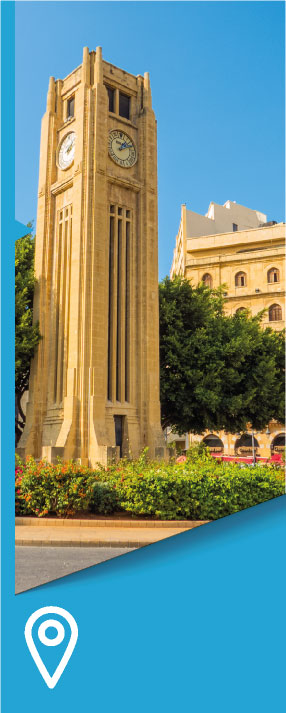

Governance Risk Management and Compliance (GRC)

23, Mar 2025 03, Apr 2025

Beirut

4750$

Governance Risk Management and Compliance (GRC)

30, Mar 2025 10, Apr 2025

Sharm ElShaikh

4750$

Governance Risk Management and Compliance (GRC)

06, Apr 2025 17, Apr 2025

Doha

5500$

Governance Risk Management and Compliance (GRC)

13, Apr 2025 24, Apr 2025

Casablanca

4950$

Governance Risk Management and Compliance (GRC)

20, Apr 2025 01, May 2025

Riyadh

4750$

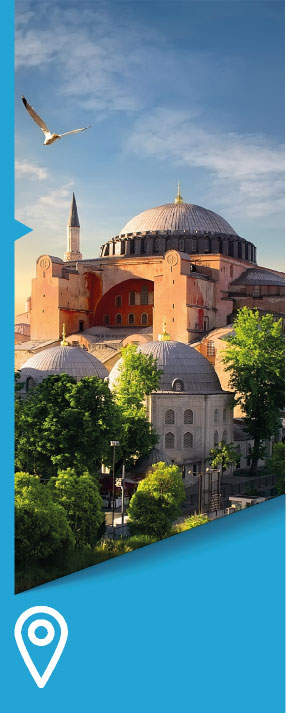

Governance Risk Management and Compliance (GRC)

28, Apr 2025 09, May 2025

Istanbul

4750$

Governance Risk Management and Compliance (GRC)

04, May 2025 15, May 2025

Jeddah

4750$

Governance Risk Management and Compliance (GRC)

11, May 2025 22, May 2025

Manama

4750$

Governance Risk Management and Compliance (GRC)

18, May 2025 29, May 2025

Beirut

4750$

Governance Risk Management and Compliance (GRC)

25, May 2025 05, Jun 2025

Khobar

4750$

Governance Risk Management and Compliance (GRC)

26, May 2025 06, Jun 2025

Singapore

6950$

Governance Risk Management and Compliance (GRC)

01, Jun 2025 12, Jun 2025

Kuwait

4750$

Governance Risk Management and Compliance (GRC)

08, Jun 2025 19, Jun 2025

DUBAI

4750$

Governance Risk Management and Compliance (GRC)

16, Jun 2025 27, Jun 2025

Kuala Lumpur

4500$

Governance Risk Management and Compliance (GRC)

22, Jun 2025 03, Jul 2025

Amman

4750$

Governance Risk Management and Compliance (GRC)

29, Jun 2025 10, Jul 2025

Khobar

4750$

Governance Risk Management and Compliance (GRC)

29, Jun 2025 10, Jul 2025

Marrakesh

4750$

Governance Risk Management and Compliance (GRC)

06, Jul 2025 17, Jul 2025

Sharm ElShaikh

4750$

Governance Risk Management and Compliance (GRC)

13, Jul 2025 24, Jul 2025

Doha

5500$

Governance Risk Management and Compliance (GRC)

20, Jul 2025 31, Jul 2025

Casablanca

4950$

Governance Risk Management and Compliance (GRC)

27, Jul 2025 07, Aug 2025

Riyadh

4750$

Governance Risk Management and Compliance (GRC)

28, Jul 2025 08, Aug 2025

Milan

6950$

Governance Risk Management and Compliance (GRC)

04, Aug 2025 15, Aug 2025

Istanbul

4750$

Governance Risk Management and Compliance (GRC)

10, Aug 2025 21, Aug 2025

Jeddah

4750$

Governance Risk Management and Compliance (GRC)

17, Aug 2025 28, Aug 2025

Manama

4750$

Governance Risk Management and Compliance (GRC)

24, Aug 2025 04, Sep 2025

Beirut

4750$

Governance Risk Management and Compliance (GRC)

01, Sep 2025 12, Sep 2025

Singapore

6950$

Governance Risk Management and Compliance (GRC)

07, Sep 2025 18, Sep 2025

Kuwait

4750$

Governance Risk Management and Compliance (GRC)

15, Sep 2025 26, Sep 2025

Berlin

6950$

Governance Risk Management and Compliance (GRC)

22, Sep 2025 03, Oct 2025

Brussels

6950$

Governance Risk Management and Compliance (GRC)

29, Sep 2025 10, Oct 2025

Zurich

6950$

Governance Risk Management and Compliance (GRC)

06, Oct 2025 17, Oct 2025

Trabzon

5750$

Governance Risk Management and Compliance (GRC)

13, Oct 2025 24, Oct 2025

Beijing

6950$

Governance Risk Management and Compliance (GRC)

20, Oct 2025 31, Oct 2025

Amsterdam

6950$

Governance Risk Management and Compliance (GRC)

27, Oct 2025 07, Nov 2025

Bangkok

6950$

Governance Risk Management and Compliance (GRC)

02, Nov 2025 13, Nov 2025

Muscat

4750$

Governance Risk Management and Compliance (GRC)

10, Nov 2025 21, Nov 2025

Toronto

7250$

Governance Risk Management and Compliance (GRC)

17, Nov 2025 28, Nov 2025

Barcelona

6950$

Governance Risk Management and Compliance (GRC)

24, Nov 2025 05, Dec 2025

London

6950$

Governance Risk Management and Compliance (GRC)

30, Nov 2025 11, Dec 2025

Cairo

3950$

Governance Risk Management and Compliance (GRC)

08, Dec 2025 19, Dec 2025

Geneva

6950$

Governance Risk Management and Compliance (GRC)

15, Dec 2025 26, Dec 2025

Vienna

6950$

Governance Risk Management and Compliance (GRC)

22, Dec 2025 02, Jan 2026

Munich

6950$

Governance Risk Management and Compliance (GRC)

29, Dec 2025 09, Jan 2026

Vienna

6950$

View course

View course

View course

View course

View course

View course